Artificial Intelligence (AI) has become a major driver of business revenue, with companies reporting measurable impacts across industries. By late 2025, 88% of organizations were using AI regularly, with top performers focusing on revenue growth rather than cost-cutting. Key takeaways from recent case studies include:

To succeed, businesses must align AI initiatives with core revenue goals, scale successful pilots, and invest in infrastructure and governance. Companies like Artech Digital offer tailored AI solutions to help businesses achieve these results.

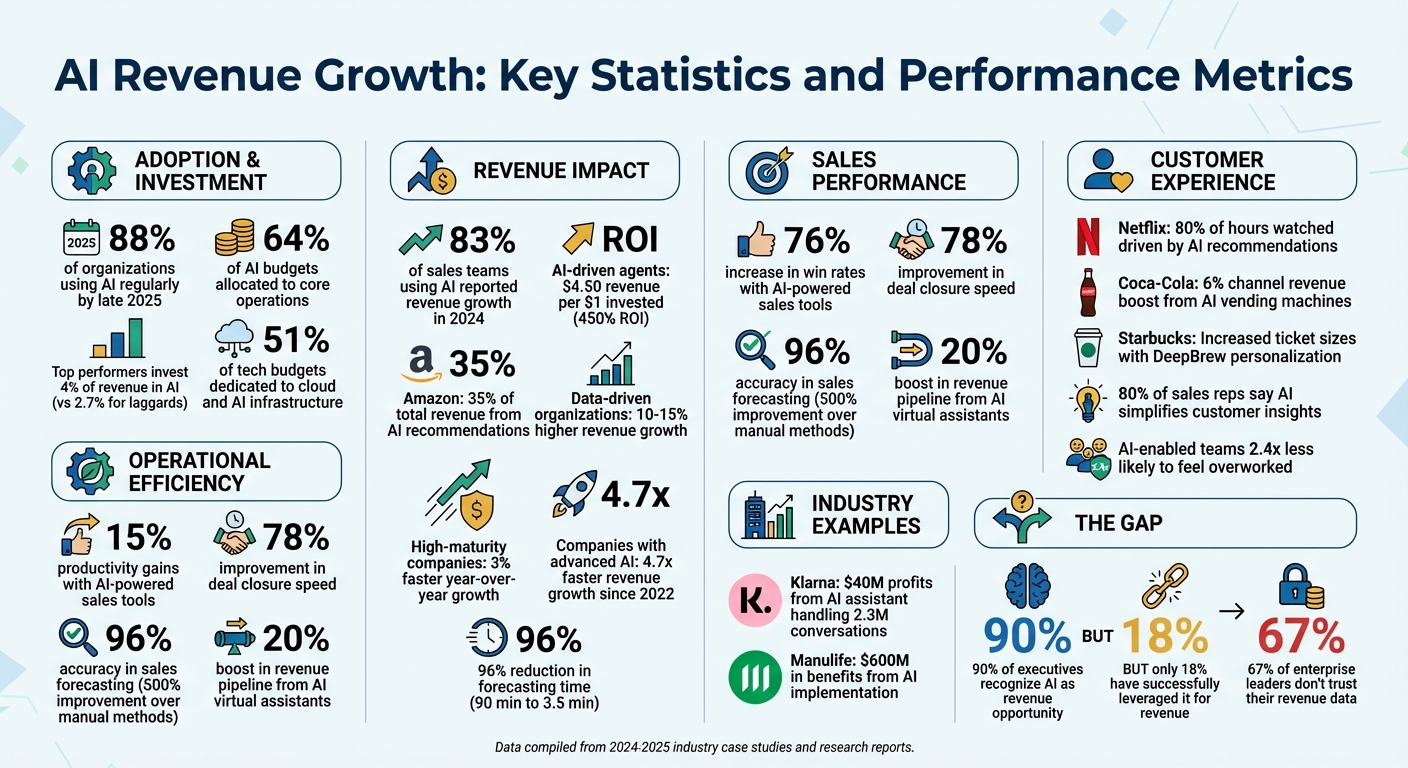

AI Revenue Growth Statistics: Key Performance Metrics Across Industries

AI projects that truly drive value are those tied directly to a company’s most critical business goals. The organizations seeing measurable success with AI don’t chase trends - they tackle their biggest revenue challenges, like acquiring leads, improving pricing accuracy, or reducing customer churn. As noted in IBM Institute for Business Value research:

Working at the core is much more complicated than grabbing low-hanging fruit around the periphery... Long term, the core should deliver far more scale and sustainable returns.

This focus on core operations explains why 64% of AI budgets are now allocated to these areas. Take the example of a U.S. home furnishings retailer: by feeding 7 million rows of data into C3 AI's Pricing Optimization application, they equipped 3,500 sales reps with actionable insights. In just three months, this effort added $15 million in revenue and boosted margins by $3 million. Even more impressively, deals closed below minimum pricing dropped from 80% to nearly 0%, solving a critical issue in pricing discipline.

The most effective AI strategies follow a "buy-plus-build" model, tailoring solutions to match the complexity of the business need. For routine tasks like summarizing meetings or drafting emails, ready-made tools suffice. But for high-stakes areas like custom pricing models or predictive lead scoring, blending off-the-shelf tools with bespoke solutions yields better results. For instance, an enterprise equipment manufacturer used AI to predict maintenance schedules and identify upsell opportunities. Their virtual sales assistant sent hyper-personalized emails, boosting their revenue pipeline by 20%.

For companies aiming to align AI initiatives with their most pressing business challenges, expert guidance can be invaluable. At Artech Digital, we specialize in linking AI projects to key revenue drivers, ensuring that your technology investments translate into lasting growth.

These strategic shifts pave the way for identifying patterns that emerge from successful AI implementations.

When analyzing successful AI use cases, three clear patterns emerge. First, leading companies focus on projects that simultaneously drive growth and improve efficiency. Second, they move past predictive AI to embrace "agentic AI" - systems that don’t just forecast outcomes but autonomously perform tasks like lead nurturing or contract drafting. Finally, they avoid fragmented solutions, opting instead for unified platforms where AI tools share infrastructure and data. This creates scalable, consistent experiences across the board.

The financial payoff for this strategic alignment is striking. Data-driven organizations report 10–15% higher revenue growth compared to their peers. Companies that fully commit to AI-powered transformation see top-line performance improvements of 15% over competitors. However, a gap remains: while 90% of executives recognize AI as a revenue opportunity, only 18% have successfully leveraged it to generate revenue. The difference lies in focusing AI on specific, high-value business objectives rather than adopting technology for its own sake.

AI-powered personalization has become a game-changer for businesses looking to increase revenue. For instance, 83% of sales teams using AI reported revenue growth in 2024, compared to only 66% of teams without it. Amazon attributes about 35% of its total revenue to its AI-driven recommendation engine, while Netflix credits its AI recommendations for 80% of total hours watched.

Starbucks' DeepBrew platform is a great example of AI in action, as it tailored rewards experiences between 2024 and 2025, leading to larger ticket sizes and improved customer lifetime value. Similarly, Sephora introduced the "Virtual Artist", an augmented reality tool that allowed customers to try on thousands of makeup products virtually. This innovation addressed common concerns like shade matching, boosting conversions and reducing returns.

Best Buy took it a step further by partnering with Accenture and Google to implement Gen AI virtual assistants. These assistants not only troubleshoot products but also provide live agents with real-time sentiment analysis and recommendations. Brian Tilzer, the company’s Chief Digital, Analytics, and Technology Officer, commented:

At Best Buy we look at how gen AI can help enable our overall enterprise strategy while solving real human needs. We're implementing it in very strategic ways across our organization to personalize and humanize the consumer electronics shopping experience like no one else can.

The benefits of AI go beyond just happy customers. 80% of sales reps using AI say it simplifies obtaining customer insights to close deals, and AI-enabled teams are 2.4x less likely to feel overworked. Coca-Cola has also embraced AI by deploying vending machines equipped with facial recognition and app data. These machines enhanced customer experiences, leading to a 6% boost in channel revenue and 15% fewer restocking trips.

AI isn’t just about improving customer interactions; it’s also revolutionizing how businesses forecast sales and allocate resources. Accurate forecasting can prevent wasted spending, yet 67% of enterprise leaders don’t trust their revenue data due to fragmented systems. AI tackles this issue by integrating data from sources like CRM, ERP, and market signals into a unified intelligence layer.

For example, a leading fintech company with $12 billion in annual revenue saw its sales opportunities grow from 20,000 to 175,000 between 2018 and 2020. By using an AI-enhanced CRM, the company reached 96% accuracy in quarterly sales predictions - a 500% improvement over manual methods.

In another case, a global agribusiness and food manufacturer operating in 120 countries replaced outdated forecasting systems with AI. Over 16 weeks, they processed 72 million rows of data to create daily demand forecasts using C3 AI Demand Forecasting. This led to an 8% improvement in forecast accuracy and uncovered $30 million in additional gross margin through better order fulfillment. Plus, the time needed to generate production schedules dropped by 96%, from 90 minutes to just 3.5 minutes.

The Clari Revenue Orchestration Platform also demonstrated AI's value. A 2025 study showed that enterprise customers using Clari reduced misallocated funds by 90%, avoided $14 million in wasted spending, and achieved a 398% ROI over three years. Additionally, an energy company used machine learning to predict customer contract renewals at various price points, reducing churn by 5% to 10%.

AI doesn’t just increase revenue - it also slashes costs and improves operational efficiency. By automating processes and streamlining workflows, companies can save money and redirect resources toward growth. For example, generative AI has been shown to cut support costs by up to 20% and reduce costs of goods sold (COGS) by 1–2 percentage points. On average, businesses report 15% productivity gains and a 9% improvement in their bottom line through generative AI.

Ant Financial’s "3-1-0" model is a standout example, automating loan approvals and quadrupling small business loan applications. Morgan Stanley also implemented an AI-powered "next-best action" engine for 16,000 financial brokers, leading to five additional outbound calls per broker daily and higher client engagement.

At Hastings Direct, AI transformed underwriting processes by improving pricing and risk models. The company achieved over 100% faster speed-to-market and tripled the number of underwriting changes it could implement. Updates became fully automated and intraday, while customer complaint letters saw improved readability scores, rising from 50 to 70, and required fewer follow-ups.

High-performing companies - often referred to as "winners" - achieve nearly 2x greater cost efficiencies from AI compared to competitors. Businesses that adopt four or more AI best practices report 12% cost efficiency, compared to just 5% for those that don’t. These examples highlight how AI not only drives revenue but also delivers operational savings across industries.

Transitioning from small-scale AI projects to full implementation requires a shift in how success is measured. Instead of focusing solely on the return on investment (ROI) of individual projects, many leading companies now evaluate AI's impact on their overall profitability and operational efficiency. This broader perspective helps establish a self-sustaining cycle where early successes generate the resources needed for further expansion.

The numbers back up this approach. While early generative AI pilots in 2023 delivered an impressive 31% ROI, scaled implementations have settled at a more sustainable 7% ROI. However, top-performing companies achieve an average ROI of 18%, far outpacing their peers. These leaders typically dedicate 4% of their revenue to AI initiatives, compared to just 2.7% for companies lagging behind.

Take Manulife, for example. Between 2024 and early 2025, the global insurer introduced an "AI Flywheel" strategy, including the rollout of its proprietary assistant, ChatMFC. By early 2025, 75% of their global workforce was using GenAI tools, contributing to $600 million in benefits in 2024 through cost savings, increased sales, and improved risk management. In their call centers alone, AI tools shaved 30–40 seconds off average call times. Reflecting on these advances, Jodie Wallis, Manulife’s Global Chief AI Officer, remarked:

Our industry has been too comfortable. This technology isn't just another tool - it's a fork in the road. We either harness it, or risk being reshaped by it.

To maintain momentum, companies are embedding AI targets directly into their budget plans. For example, a global bank launched over 20 GenAI pilots, with funding baked into its budget. This allowed them to focus on nine high-value areas, with some initiatives receiving $20 million to $50 million to drive major transformations. This approach ensures AI becomes a core business priority rather than an experimental side project.

Additionally, organizations are reallocating funds toward core business operations, which now account for 64% of AI budgets, rather than chasing peripheral opportunities (36%). These financial frameworks are critical for unlocking AI's potential to drive revenue and operational improvements. With these self-funding strategies in place, the next step is scaling AI solutions to transform workflows across the organization.

Scaling AI isn't just about automating tasks - it often means rethinking entire workflows. For instance, a European insurer revamped its commercial model in just 16 weeks by deploying a network of AI agents. These agents centralized over 1,000 documents and reviewed 95% of sales calls, a dramatic increase from just 3%. The result? 25% shorter call times and sales conversion rates that were 2 to 3 times higher.

Speed is another critical factor in scaling AI solutions. Industry leaders take just 5 to 7 months to move from concept to large-scale implementation, while slower adopters take 15 to 17 months. A US airline showcased the benefits of rapid deployment by using predictive insights to personalize compensation for flight disruptions. This tailored approach boosted customer satisfaction by 800% and reduced churn among high-value travelers by 59%.

The rise of agentic AI - autonomous systems that can manage complex, multi-step workflows - marks the next frontier for AI adoption. Companies with advanced AI capabilities have grown their annual revenue by 3 percentage points more (or 4.7x faster) than less mature organizations since 2022. On average, leaders deploy 4.5 AI use cases, compared to just 3.3 for slower adopters, and achieve double the cost efficiencies.

Certain tools, like AI-powered web apps and custom machine learning models, have proven especially effective at scale. For example, AI-assisted coding can cut business and IT costs by an average of 63% while boosting revenue by 18%. Companies like Artech Digital (https://artech-digital.com) specialize in creating scalable solutions, such as custom AI agents, advanced chatbots, and fine-tuned large language models that can be integrated across various business functions.

To scale successfully, many organizations are establishing centralized hubs or "agent factories" to standardize reusable frameworks and shared data products. Firms making 75% or more of their technology and data accessible across the organization are 40% more likely to scale AI use cases effectively. This kind of infrastructure ensures that successful pilots can be quickly replicated across departments, avoiding inefficiencies and "agent chaos."

Achieving long-term success with AI means going beyond scalable strategies - it requires solid governance and smart partnerships.

Sustaining AI-driven revenue growth isn’t just about having the right technology in place. It also demands active involvement from senior leadership, which is three times more common in high-performing organizations.

To build trust and ensure accuracy, it's crucial to implement clear human-in-the-loop validation processes. This helps address the 51% of cases where unchecked AI leads to negative outcomes. Additionally, companies are dedicating 51% of their tech budgets to cloud and AI infrastructure. This investment lays the foundation for a strong digital core, enabling seamless scaling of AI systems.

Centralized governance hubs play a vital role here, offering standardized frameworks that evolve as AI expands. High-performing organizations also focus on mitigating key AI-related risks - such as privacy, explainability, reputation, and compliance. Notably, companies that invest over 0.5% of their revenue in AI outperform their industry peers by 21%.

Strong governance frameworks, however, are only part of the equation. External expertise is often necessary to fill talent gaps and accelerate AI integration on a larger scale.

With 45% of companies struggling to find skilled AI talent, external partnerships have become essential. Collaborating with AI solution providers can enhance operational maturity, leading to 2.5 times higher revenue growth.

When choosing a partner, look for providers that bring not just technical knowledge but also strategic alignment and the ability to drive end-to-end transformation. For example, a collaboration between Accenture and an e-commerce leader resulted in AI-powered advertising optimizations that boosted ad spending for sellers by over 30% year-over-year.

A great example of this approach is Artech Digital (https://artech-digital.com), which offers tailored solutions like custom AI agents, advanced chatbots, and fine-tuned language models. These tools integrate directly into core business workflows, helping companies build scalable infrastructures such as self-service data marketplaces and federated governance models.

As Sasha Jory, CIO at Hastings Direct, wisely points out:

AI must be used in the right areas for performance improvement and enhancement, and the technology must be implemented carefully and safely.

Successful companies have a clear edge when it comes to leveraging AI. On average, they implement 4.5 AI use cases, compared to just 3.3 for less successful peers, resulting in nearly double the cost efficiencies. Additionally, 90% of organizations report that AI has either met or exceeded their expectations. These trends align closely with what we’ve seen in standout AI case studies.

What sets the leaders apart? They don’t stop at initial pilots - they integrate AI deeply into their core operations. Instead of spreading efforts thin across countless initiatives, they zero in on high-impact areas like dynamic pricing, next-best-action recommendations, and automated responses. This focused approach pays off, with high-maturity companies achieving 3% faster year-over-year growth.

Interestingly, the AI narrative is shifting. Early adopters emphasized cost-cutting, but now, 67% of businesses anticipate that AI’s primary role by 2029 will be driving growth and expansion. While nearly all executives (97%) acknowledge the transformative potential of generative AI, only 18% have tapped into its ability to generate revenue. This gap presents a massive opportunity for businesses ready to act strategically.

With these lessons in mind, now is the time to take action. Start by identifying your most pressing business challenges - whether it’s high customer churn, low-margin pricing, or operational inefficiencies. Focus on use cases that promise significant impact and quick returns, and tackle data quality issues head-on, as 47% of executives cite poor data as a major hurdle.

Adopt a "buy-plus-build" approach. For routine tasks like meeting summaries, consider off-the-shelf solutions. For use cases that could provide a competitive edge - like custom AI agents or advanced chatbots - invest in tailored development. If you’re looking for specialized AI solutions, companies like Artech Digital (https://artech-digital.com) can help design scalable systems that integrate seamlessly into your workflows.

To ensure success, form cross-functional teams that bring together marketing, IT, finance, legal, and HR. This "squad" model can streamline governance, funding, and talent alignment. Make sure senior leadership is actively involved. Finally, foster a culture where experimentation is encouraged, and mistakes are seen as learning opportunities. Businesses that act decisively - with a clear strategy, strong leadership, and the right partnerships - will be well-positioned to capitalize on AI’s potential for driving revenue growth.

To tie AI initiatives directly to revenue goals, businesses need to zero in on data-driven use cases that influence key metrics like sales growth, customer lifetime value, or conversion rates. Companies that succeed in this area often focus on high-quality data and choose AI projects targeting critical revenue drivers such as predictive sales analytics, personalized marketing, or dynamic pricing. For example, organizations using AI for demand forecasting or optimizing ad spend frequently report noticeable revenue gains.

Here’s how businesses can set themselves up for success:

When businesses couple strategic planning with effective execution, AI stops being just a buzzword and becomes a tangible driver of revenue growth. Companies like Artech Digital provide tailored solutions, including custom machine learning models and advanced AI tools, to help organizations achieve these objectives.

AI-powered sales and revenue forecasting brings a whole new level of precision compared to older methods. By processing massive amounts of historical data, customer interactions, and market trends, AI delivers real-time, highly accurate predictions. These insights enable businesses to set practical sales goals and distribute resources more efficiently. Companies that embrace AI for forecasting often report revenue growth of 10–15% and a 10–20% boost in sales ROI.

Beyond accuracy, AI enhances productivity by automating repetitive tasks like data entry, freeing up sales teams to focus on closing deals. Predictive analytics also drive higher win rates - by as much as 35% - and can generate up to 77% more revenue per sales representative. Organizations using AI are also over 1.3 times more likely to maintain steady revenue growth.

Artech Digital supports U.S. businesses in tapping into these advantages by integrating tailored AI models, cutting-edge forecasting tools, and smart chatbots into their existing systems. This empowers teams to make informed, data-driven decisions on a larger scale.

Scaling AI from small pilot projects to full-scale implementation isn’t just about ambition - it demands a well-defined strategy and consistent execution. The first step? Building a solid data and technology foundation. This means ensuring your data is clean, well-organized, and properly managed. Pair that with a flexible AI infrastructure, and you’ll be ready to move past isolated experiments and start addressing meaningful business challenges. Prioritize AI use cases that align with your business objectives and have the potential to deliver measurable financial results.

From there, it’s crucial to embed AI into your core operations. This involves forming cross-functional teams that bridge gaps between departments, ensuring collaboration and seamless integration. Think of AI not as a standalone tool but as a managed asset that’s woven into your workflows where it can create the greatest impact. By co-developing solutions with employees and refining them based on real-world feedback, you’ll foster greater adoption and achieve practical results.

For businesses seeking expert guidance, Artech Digital offers a range of AI integration services. From AI-powered web applications to custom agents, advanced chatbots, and fine-tuned large language models, they provide tailored solutions to help organizations unlock growth and efficiency through AI.

.png)

.png)