Edge AI technology is transforming industries, but it comes with complex compliance challenges. Here’s what you need to know:

Failing to comply with these regulations can result in hefty fines, reputational damage, and loss of consumer trust. Businesses must prioritize compliance to stay competitive and avoid penalties.

This introduction simplifies the key points and avoids promotional language. Let me know if you'd like to expand on any section or include a comparison table.

The 2025 Federal AI Executive Order outlines critical requirements for deploying edge AI technologies. This directive applies to all federal agencies, urging them to address AI within their respective areas of expertise. For companies involved in edge AI, understanding and adhering to these regulations is key to staying compliant and securing government contracts. These federal rules also lay the groundwork for more specific industry-based regulations.

The Executive Order emphasizes the need for lawful, secure, and privacy-conscious data practices. It tasks the Department of Commerce and NIST with developing guidelines that encourage the adoption of privacy-enhancing technologies (PETs). The 2024 National Counterintelligence Strategy highlights that adversaries are particularly interested in sensitive personal data, such as biometric, genomic, healthcare, geolocation, financial, and politically sensitive information.

Additionally, the Data Security Program under Executive Order 14117 enforces export controls to block foreign adversaries from accessing sensitive U.S. government-related data and other critical information.

The Executive Order imposes strict security measures for edge AI systems. Contractors are required to implement robust risk management practices throughout product development and establish strong AI governance policies. NIST is directed to create guidelines and best practices for building AI systems that are safe, secure, and trustworthy.

Agencies must assess and report on critical AI risks, including mechanical failures and potential physical or cyber-attacks. In the financial sector, the Treasury Department is preparing a report to outline best practices for mitigating AI-specific cybersecurity risks within financial institutions.

The Order introduces a "high impact" AI category, which demands heightened scrutiny and due diligence. Agencies must disclose in their solicitations if the planned use of an AI system falls under this category and establish requirements for ongoing testing and monitoring during the contract lifecycle. The directive also stresses that AI systems must remain free from ideological bias or engineered social agendas, and it enforces the separation of contractor and government data.

"This Executive Order represents a significant contribution to the subject of accountability in how AI is developed and deployed across organizations." - EY US

Beyond general AI regulations, the Executive Order introduces sector-specific compliance frameworks. For example, in the financial sector, the Treasury Department's upcoming report will provide best practices for managing cybersecurity risks in AI systems that handle sensitive financial data.

The Order also prioritizes the use of American-developed AI solutions in government projects, giving domestic edge AI providers a competitive advantage in securing federal contracts.

For companies deploying edge AI, these federal requirements present a complex compliance landscape that goes well beyond standard data protection laws. The focus on transparency, security, and prioritizing American AI technologies is expected to shape the design, deployment, and monitoring of edge AI systems in the years ahead.

California is taking the lead in AI regulation, introducing laws that significantly influence how businesses implement edge AI systems. These updated rules expand data protection to include AI-generated data, creating new compliance hurdles. Let’s break down how these privacy measures, transparency requirements, and industry-specific rules are reshaping edge AI compliance in the state.

Under California's revised privacy laws, AI-generated data is now classified as personal information. The California Consumer Privacy Act (CCPA) grants consumers rights to access, delete, or correct personal data, and this now extends to data generated by AI systems. As of January 2025, AB 1008 explicitly states that AI-generated data must be treated with the same protections as traditional personal information. This means businesses using AI systems must ensure these rights apply to any data their systems process or generate.

The CCPA applies to for-profit businesses operating in California that meet at least one of these criteria:

Additionally, SB 1223 introduces new restrictions on the use and sharing of neural data, categorizing it as sensitive personal information. This is particularly critical for edge AI systems that process biometric or neurological data.

The California AI Transparency Act sets strict disclosure standards for companies using AI. Businesses with over 1,000,000 monthly users in California must offer free tools to identify AI-generated content. Outputs must include both clear markers and embedded metadata. Starting January 1, 2026, these companies will also need to adopt detailed transparency practices, such as tracking the origin of data and providing users with control over personal data that AI systems access, generate, or alter. Non-compliance could result in fines of $5,000 per violation.

In January 2025, California also enacted AB 2885, which defines AI as “an engineered or machine-based system capable of using input to create outputs that influence physical or virtual environments.” Another law, AB 2013, requires developers to publish high-level summaries of their training datasets on their websites. These measures aim to make AI systems more accountable and understandable to the public.

California’s approach introduces unique challenges for specific industries. For instance:

To navigate these evolving rules, businesses need to update their data practices, privacy policies, and licensing agreements. For organizations seeking expert guidance to ensure compliance while integrating edge AI, companies like Artech Digital (https://artech-digital.com) offer specialized support tailored to these regulatory demands.

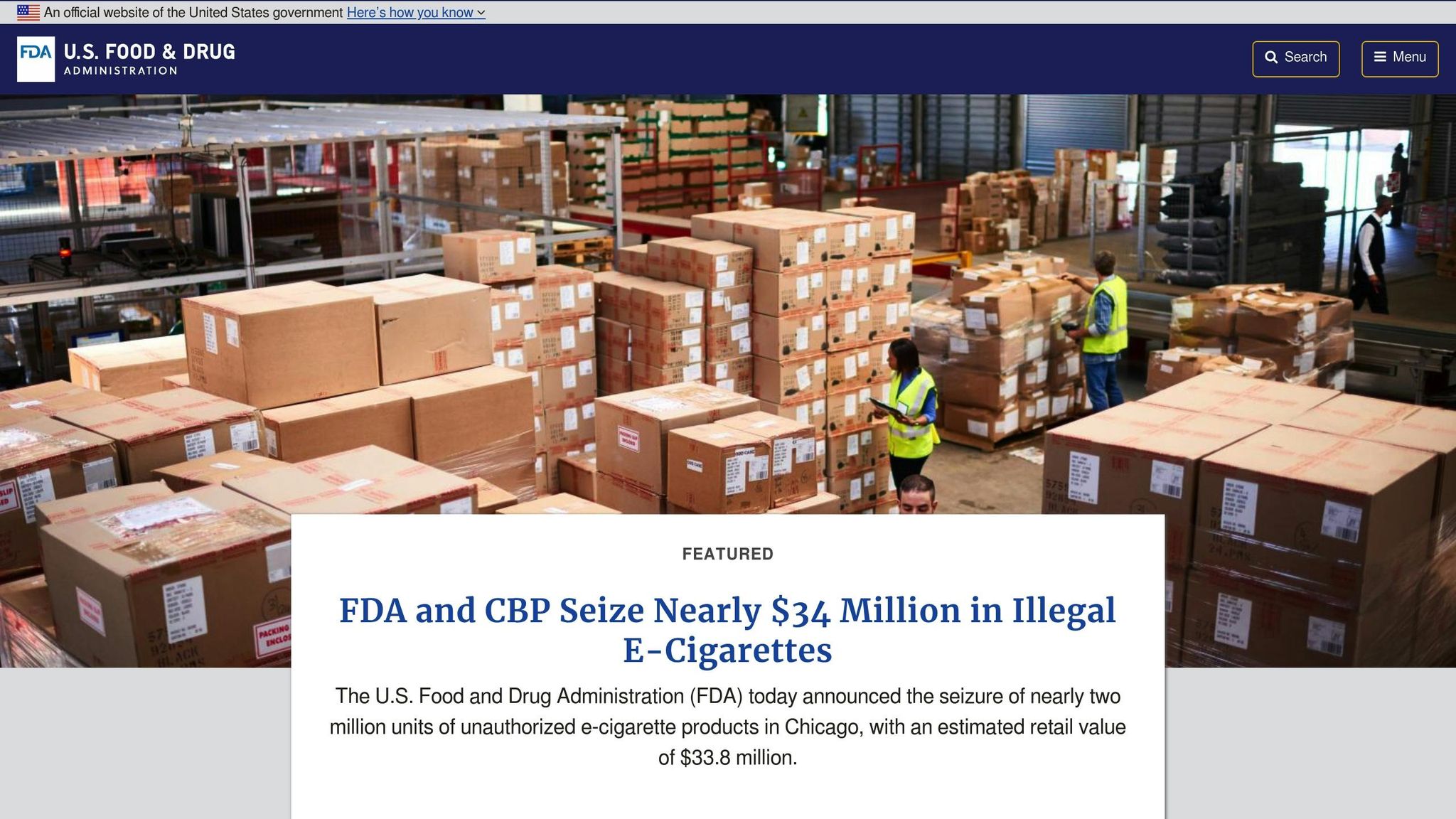

The FDA has laid out clear guidelines for AI systems in healthcare, aiming to balance technological progress with patient safety. These guidelines are tailored to address the unique demands of healthcare, particularly the need for stringent patient safety measures and robust data security. Building on existing federal and state regulations, the FDA framework focuses on managing the distinct risks associated with AI in healthcare. As of December 2024, the FDA's AI/ML-enabled Medical Device List included 1,016 authorized AI/ML-enabled medical devices, with over 350 added since January 2023. This rapid expansion highlights both the growing role of AI in healthcare and the challenges of regulating it.

The FDA requires healthcare organizations to provide documented evidence of safety and efficacy through rigorous validation processes. To protect patient data processed by AI models, organizations must implement strong cybersecurity measures, ensuring that sensitive information remains secure and unaltered. These requirements complement existing edge AI compliance protocols by adding device-specific safety measures.

Central to these efforts is the FDA's Good Machine Learning Practice (GMLP), which emphasizes key principles such as data quality, performance monitoring, transparency, and minimizing bias. Unlike traditional medical devices, AI tools require ongoing post-market monitoring to track their performance, gather user feedback, and address safety concerns throughout their lifecycle.

One notable example is the IDx-DR device, the first FDA-authorized AI diagnostic tool that operates without human interpretation. Clinical trials demonstrated its high accuracy, but the FDA also mandated a clear definition of the device's limitations to prevent misuse.

The FDA places a strong emphasis on the transparency and reliability of AI algorithms. Companies must show that their AI models perform consistently across diverse patient populations, reducing bias and ensuring fair healthcare outcomes.

To address the evolving nature of AI, the FDA introduced the Predetermined Change Control Plan (PCCP). This framework allows pre-approved updates to AI models without requiring new regulatory submissions for every modification. By offering a flexible regulatory pathway, the FDA acknowledges the continuous development of AI systems while maintaining oversight.

"FDA states its intention behind the finalized guidance is 'to provide a forward-thinking approach to promote the development of safe and effective' medical devices that include one or more AI-enabled device software functions."

These measures ensure that AI advancements in healthcare remain dynamic while adhering to strict regulatory standards.

The FDA offers multiple approval pathways based on the risk level of the device: De Novo, Premarket Clearance (510(k)), and Premarket Approval. Before deploying AI systems, healthcare providers must verify FDA clearance. These pathways reflect the broader focus on risk management found in federal and state regulations.

Software defects account for about 20% of medical device recalls, underlining the importance of robust quality management systems. To address this, the FDA encourages early engagement with developers through the Q-Submission program, allowing for feedback before formal regulatory applications are submitted.

For organizations developing healthcare AI solutions, compliance needs to be integrated from the start. Companies like Artech Digital (https://artech-digital.com) specialize in helping healthcare providers navigate these complex regulatory landscapes and implement compliant AI systems.

Finally, staff training is a critical part of the compliance process. The FDA expects healthcare organizations to train clinical teams on how AI tools function as support systems. This ensures that clinicians can identify outputs that deviate from their expertise and report them accordingly. This approach reinforces the idea that AI should complement, not replace, clinical judgment.

The Securities and Exchange Commission (SEC) has set clear guidelines for financial institutions employing edge AI technologies, aiming to protect investors while encouraging advancements in the field. With the financial AI market expected to hit $190 billion by 2030, growing at an annual rate of 30.6%, these regulations play a crucial role. The SEC, alongside the Financial Industry Regulatory Authority (FINRA), requires broker-dealers, exchanges, and banks to adopt advanced surveillance and reporting systems to manage AI operations effectively. This framework emphasizes privacy, security, and accountability.

Financial firms must prioritize safeguarding sensitive data. The SEC mandates the use of strong encryption, strict access protocols, and well-documented data flows to prevent unauthorized access. For instance, in 2021, First American Financial faced SEC charges after cybersecurity lapses exposed over 800 million documents containing Social Security numbers and financial details. Similarly, Facebook incurred a $100 million fine in 2019 for failing to disclose risks tied to data misuse during the Cambridge Analytica scandal.

The SEC also stresses the importance of robust data governance. Firms are expected to implement measures to protect sensitive data processed by AI systems, as breaches could lead to enforcement actions. A proactive approach, embedding privacy considerations into the AI development process, has become a widely adopted practice.

Beyond privacy, the SEC enforces strict security standards to manage risks associated with AI in financial operations. Financial institutions are required to develop governance frameworks that address potential threats, such as cyber-attacks, and conduct regular audits to maintain compliance with anti-discrimination laws. Continuous monitoring of AI algorithms is also essential.

For example, Nasdaq processes 750,000 alerts annually to detect anomalies. Companies are encouraged to invest in governance frameworks, train their teams in ethical AI practices, and deploy tools to manage risks effectively. AI systems in finance can now automate tasks like regulatory filings and investor disclosures with impressive precision, even adapting to regulatory changes as they happen. However, human oversight and routine compliance checks remain necessary to ensure these systems operate responsibly.

Transparency is another cornerstone of SEC regulations. Financial institutions must clearly disclose how AI influences decision-making processes. AI systems should be interpretable, allowing both regulators and clients to understand their operations. Additionally, algorithms must be designed to avoid biases that could lead to unfair outcomes.

Organizations are held accountable for the results of their AI systems, whether in investment advice or lending decisions. In one case, a fintech company faced penalties after its AI model disproportionately denied loans to minorities. Similarly, deceptive practices by AI-powered robo-advisors have led to regulatory actions.

The SEC also evaluates whether robo-advisors comply with fiduciary standards under the Investment Advisers Act of 1940 and keeps a close watch on emerging AI-specific rules. As the regulatory landscape evolves, the agency is exploring new measures to address the unique challenges posed by AI technology.

For financial institutions, the challenge lies in balancing innovation with regulatory compliance. AI applications must remain transparent, auditable, and consistent. To navigate these intricate requirements, companies like Artech Digital (https://artech-digital.com) specialize in creating AI solutions that align with SEC standards while driving progress in the financial sector.

The Federal Trade Commission (FTC) plays a key role in safeguarding consumers in the ever-evolving world of edge AI. Through Section 5 of the FTC Act, the agency has the authority to address unfair or deceptive trade practices, and its focus has expanded to include the unique challenges posed by edge AI technologies. These standards, which align with federal and state regulations, aim to ensure that edge AI solutions are deployed responsibly. As FTC Chair Lina M. Khan puts it:

"Using AI tools to trick, mislead, or defraud people is illegal".

By combining enforcement actions, policymaking, and consumer education, the FTC works to protect personal data and hold businesses accountable, especially as edge AI systems increasingly handle sensitive information.

The FTC has made it clear that protecting sensitive data is a top priority. In January 2024, FTC Commissioners stated:

"sensitive data triggers heightened privacy obligations and a default presumption against its sharing or sale".

Recent cases highlight this commitment. For example, in February 2024, the FTC reached a $16.5 million settlement with Avast for misrepresenting data practices and failing to secure proper consent before collecting and selling browsing data. Another settlement with Blackbaud Inc. required the company to address security gaps and create a comprehensive information security program. Businesses must adopt strict data retention policies, limit data collection to what is absolutely necessary, and conduct regular Privacy Impact Assessments.

Under Section 5 of the FTC Act, companies are required to implement reasonable cybersecurity measures. The FTC Safeguards Rule also obligates financial institutions to design security programs tailored to their operations, factoring in the complexity and sensitivity of customer data. Key security measures include role-based access controls, multi-factor authentication, and encryption for data both at rest and in transit. Financial institutions face additional obligations to protect consumer data.

To ensure robust security, companies should develop and test Cybersecurity Incident Response Plans, conduct regular employee training, and establish strong internal data governance processes. These measures, combined with transparency requirements, aim to maintain trust in edge AI systems.

Transparency is a cornerstone of the FTC’s approach to AI regulation. Companies must openly disclose their use of AI and rigorously test systems for bias, especially in areas like credit scoring or lending. Enforcement actions have underscored these expectations: one fintech firm faced penalties for using an AI model that disproportionately denied loans to minority applicants, while another was cited for robo-advisors overstating returns.

In September 2024, the FTC launched "Operation AI Comply", targeting deceptive practices such as fake reviews, misleading "AI Lawyer" services, and false promises of AI-driven income. Businesses are required to clearly disclose terms, obtain informed consent before billing, provide simple cancellation options, and maintain thorough documentation of AI system development and monitoring.

The FTC’s guidelines adapt to the specific needs of different industries using edge AI. For instance, in April 2024, the agency finalized a consent order with data broker X-Mode Social and its successor Outlogic LLC, prohibiting the sale of sensitive location data without proper safeguards. Companies handling biometric data must secure written, informed consent, provide clear privacy notices, and establish strict policies for data retention and destruction.

These tailored approaches ensure that AI technologies are not misused for deceptive or discriminatory purposes. As FTC Chair Lina M. Khan explains:

"The FTC's enforcement actions make clear that there is no AI exemption from the laws on the books. By cracking down on unfair or deceptive practices in these markets, FTC is ensuring that honest businesses and innovators can get a fair shot and consumers are being protected".

Together with federal executive orders and state regulations, these FTC guidelines create a comprehensive framework for edge AI compliance. For businesses navigating these complex requirements, partnering with experts like Artech Digital (https://artech-digital.com) can help ensure that edge AI systems not only meet regulatory standards but also achieve operational success.

New York has stepped up as a trailblazer in AI regulation, implementing laws that directly influence how businesses use advanced AI systems. The state's approach zeroes in on preventing discrimination and promoting transparency, particularly in employment and consumer-focused applications. With one-third of NYC's venture capital in 2023 flowing into AI projects, these regulations are shaping the tech industry's future. By building on existing federal and state standards, New York reinforces its dedication to fair and accountable AI practices.

At the heart of New York's AI regulation is Local Law 144, which specifically addresses automated employment decision tools (AEDTs). This law applies to any employer or agency using AI to screen NYC residents, covering tools that either assist or replace human decision-making.

Local Law 144 requires employers to take several steps to ensure fairness and transparency. These include:

Council Member James Vacca, who spearheaded this legislation, explained:

"My ambition here is transparency, as well as accountability".

Non-compliance comes with financial penalties - $500 for the first violation and $1,500 for subsequent ones. While these fines may not seem steep, the reputational harm and potential legal challenges could be far more costly.

New York's AI regulations extend beyond audits and notifications to include robust data privacy measures. The state's LOADinG Act mandates businesses to evaluate cybersecurity vulnerabilities and privacy risks, requiring them to implement safeguards to address any issues found. Additionally, New York has bolstered protections for sensitive medical and insurance data to minimize identity theft risks. Businesses must notify affected individuals of data breaches within 30 days and inform the Department of Financial Services if New York residents are impacted.

Proposed legislation, A9315, seeks to regulate electronic employee monitoring. It would require employers to have a legitimate purpose for monitoring, provide clear notifications before data collection, and destroy data once its purpose is fulfilled or upon an employee's termination. Considering that nearly 99% of Fortune 500 companies now use automated tools for candidate screening, these rules could significantly influence hiring practices.

Governor Kathy Hochul emphasized the importance of these measures, stating:

"New Yorkers should never have to worry about their personal information being misused or falling into the wrong hands. Hochul said the legislative package she signed constitutes 'bold action to hold companies accountable, strengthen protections, and give consumers the transparency and security they need and deserve'".

In line with federal safety guidelines, New York has introduced strict risk management requirements for AI systems. Proposed Assembly Bill A768 aims to tackle algorithmic discrimination against protected groups. Developers are required to actively address known and foreseeable discrimination risks by implementing detailed risk management policies. These policies must outline the principles, processes, and personnel involved in identifying and mitigating such risks, aligning with guidance from the National Institute of Standards and Technology (NIST) or similar global frameworks.

The legislation also mandates that high-risk AI systems undergo impact assessments to analyze potential discrimination risks. Developers of general-purpose AI models must maintain detailed technical documentation, including information about training and testing processes. Additionally, Senate Bill S1169, known as the "New York Artificial Intelligence Act", requires independent audits of high-risk AI systems, ensuring both internal compliance and external oversight.

New York's AI regulations balance universal transparency principles with industry-specific needs. In January 2024, NYC established a Steering Committee to oversee AI use in city government and created an AI Advisory Network, which includes representatives from private companies and academic institutions, to guide the city's AI initiatives.

For businesses implementing edge AI solutions, staying compliant requires careful planning. Companies must focus on employee notification protocols, implement rigorous oversight mechanisms, conduct regular impact assessments, and ensure meaningful human oversight in AI decision-making. Detailed documentation and disclosure strategies are also critical to avoiding legal and regulatory pitfalls.

To navigate New York's complex compliance landscape, organizations can turn to experts like Artech Digital (https://artech-digital.com), who specialize in helping businesses meet these stringent requirements for edge AI systems.

Illinois has set the bar high when it comes to protecting biometric privacy through the Biometric Information Privacy Act (BIPA). This law establishes strict rules for businesses using edge AI systems that handle biometric data like facial recognition and fingerprints. As the ACLU of Illinois points out, "BIPA is the one recourse Illinoisans have to control their own fingerprints, facial scans, and other crucial information about their bodies". What makes BIPA stand out is that it allows individuals to directly sue companies for violations, making it the most stringent biometric privacy law in the U.S.

Biometric data is especially sensitive because it’s permanent. Unlike a password or email address, "biometric information can never be changed!". Below, we’ll dive into BIPA’s key requirements for consent, security, and transparency.

Under BIPA, businesses must meet clear consent and notification standards before collecting biometric data from Illinois residents. This includes informing individuals in writing about the type of data being collected, its purpose, how long it will be stored, and when it will be destroyed. Written consent is mandatory before any collection begins .

Additionally, BIPA prohibits companies from selling or profiting from biometric information. Businesses are required to set up a retention schedule and establish firm rules for permanently deleting biometric data when it’s no longer needed for its original purpose.

BIPA enforces robust security measures to protect biometric data. Companies must encrypt data both during transit and while stored, implement strict access controls, and maintain logs of all data access to prevent unauthorized use or breaches . Regular security audits and vulnerability assessments are crucial to keeping these protections up to date.

For edge AI systems, the stakes are even higher. Businesses must conduct thorough risk assessments that evaluate how biometric data is collected, used, and stored across all devices and systems. Edge computing, with its distributed nature, can create additional vulnerabilities that require careful management.

Transparency is another cornerstone of BIPA. Companies must create a publicly accessible policy that explains their retention schedule and data destruction practices. They are also required to provide clear, written notices and secure consent using straightforward language . To stay compliant, businesses should carry out regular audits, provide employee training, and adopt data minimization strategies. Employees handling biometric data must be well-versed in BIPA’s requirements .

Importantly, businesses cannot shift liability for BIPA violations to third-party vendors. As cybersecurity expert Anjali Das from Wilson Elser law firm emphasizes, "Companies that hire a third-party vendor to collect and process biometric data can't just point the finger, blame them and walk away from liability exposure".

The financial risks of non-compliance are steep. Statutory damages range from $1,000 for each negligent violation to $5,000 for each intentional or reckless violation. A recent amendment limits liability to a single violation per individual, provided the scans are collected in the same manner. However, for companies with large user bases, these costs can still add up quickly.

For businesses deploying edge AI systems that handle biometric data, working with experts like Artech Digital can help navigate BIPA's complex requirements while ensuring AI applications remain effective and compliant.

Edge AI compliance isn't just about avoiding penalties - it's a way to build trust and gain a competitive edge. With 73% of businesses already leveraging analytical and generative AI, and 72% of top-performing CEOs attributing competitive advantage to the most advanced AI, compliance has shifted from being a legal checkbox to a strategic priority.

The stakes for non-compliance are high. Companies risk fines of up to $35 million or 7% of global revenue. But the financial impact doesn’t stop there - reputational damage and potential exclusion from key markets can have far more lasting consequences. Federal agencies are actively enforcing these standards, making it clear that businesses must take compliance seriously.

Beyond penalties, consumer expectations are evolving. According to a 2024 KPMG survey, 78% of consumers believe organizations using AI have a responsibility to ensure it's developed ethically. This growing demand for ethical AI directly influences business value. As compliance expert Jan Stappers highlights:

"The evolution of AI requires compliance leaders to be forward-thinking and proactively engage with the growing regulatory landscape to mitigate risks and maximize opportunities for innovation".

The regulatory environment is becoming increasingly intricate. Federal and state-level initiatives, such as California's transparency laws and New York's accountability measures, showcase how quickly these frameworks are advancing. Regulations like the Federal AI Executive Order and FDA guidelines for healthcare applications add further complexity. Meanwhile, the EU AI Act is poised to set a global standard for AI governance. Industry-specific rules are also expanding, particularly in healthcare, finance, and employment sectors.

To stay ahead, businesses need proactive compliance strategies. This means creating regulatory watch teams to stay updated, implementing robust AI governance frameworks, and investing in tools like explainable AI systems. Equally important is training employees on ethical AI practices and collaborating with legal and compliance experts who understand these ever-evolving regulations . These efforts not only ensure compliance but also position businesses for long-term success.

Viewing compliance as a strategic advantage helps mitigate risks, foster trust, and attract investment. For companies navigating this complex landscape, partnering with experts like Artech Digital (https://artech-digital.com) can make all the difference. With expertise in AI-powered applications, custom agents, computer vision, and machine learning, Artech Digital ensures your AI solutions remain both cutting-edge and compliant as regulations continue to evolve.

In the U.S., edge AI compliance is shaped by a combination of federal guidelines and state-specific laws. At the federal level, there’s no single, comprehensive AI regulation. Instead, businesses must navigate existing laws related to privacy, anti-discrimination, and industry-specific requirements. Frameworks like the AI Bill of Rights provide guidance, but they don’t carry legal weight. On the state level, places like California and New York have introduced their own AI regulations, which can lead to a patchwork of rules that sometimes conflict.

To handle these complexities, businesses should stay informed about both federal and state requirements. Consulting legal experts is a smart move, as is crafting compliance strategies that can adapt to changing regulations. Partnering with industry groups can also keep companies in the loop and help push for more uniform rules across different jurisdictions.

The Illinois Biometric Information Privacy Act (BIPA) sets strict guidelines on how businesses handle biometric data, such as fingerprints, facial scans, and voiceprints. For companies using edge AI solutions, this means they must secure explicit and informed consent from individuals before collecting or processing any biometric information.

Failing to comply with BIPA can lead to hefty penalties. Companies may be fined $1,000 per violation for negligence or $5,000 per violation for intentional or reckless misconduct. On top of that, individuals have the right to file lawsuits, which has resulted in a surge of legal actions against businesses that mismanage biometric data. To steer clear of these challenges, organizations leveraging edge AI should adopt strong data protection measures and ensure they meet all BIPA requirements.

To meet the requirements of AI regulations in California and New York, businesses need to prioritize transparency, accountability, and ethical practices when designing and deploying AI systems.

In California, the AI Transparency Act emphasizes the importance of disclosing the use of generative AI, particularly in public-facing applications. This aims to curb misinformation and promote ethical standards. New York takes a similar stance, requiring transparency in automated decision-making processes to ensure public agencies remain accountable for outcomes influenced by AI.

Here are some practical steps businesses can take:

By integrating these practices, businesses not only comply with legal standards but also build trust and demonstrate responsibility in their use of AI.

.png)

.png)